rsu tax rate ireland

This is true whether were talking about. Register your MyAccount in Revenue.

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

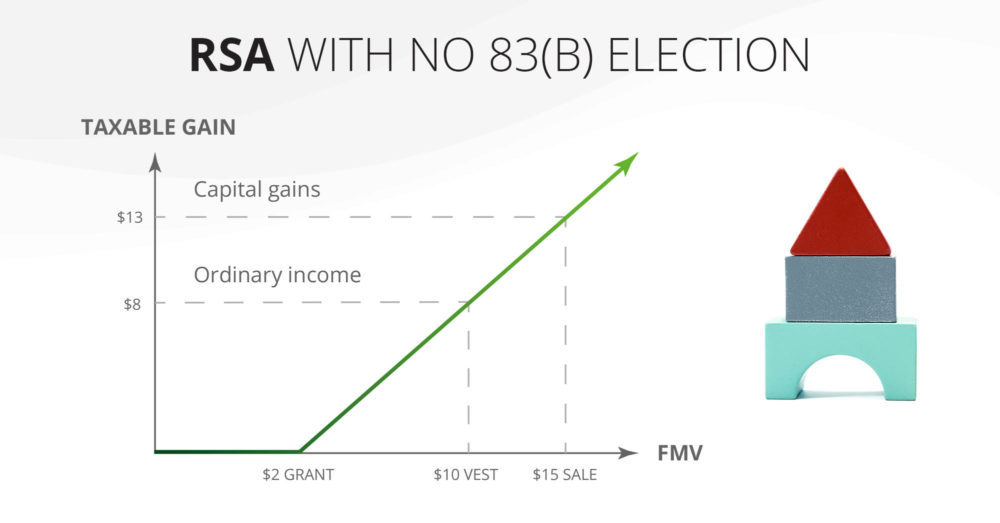

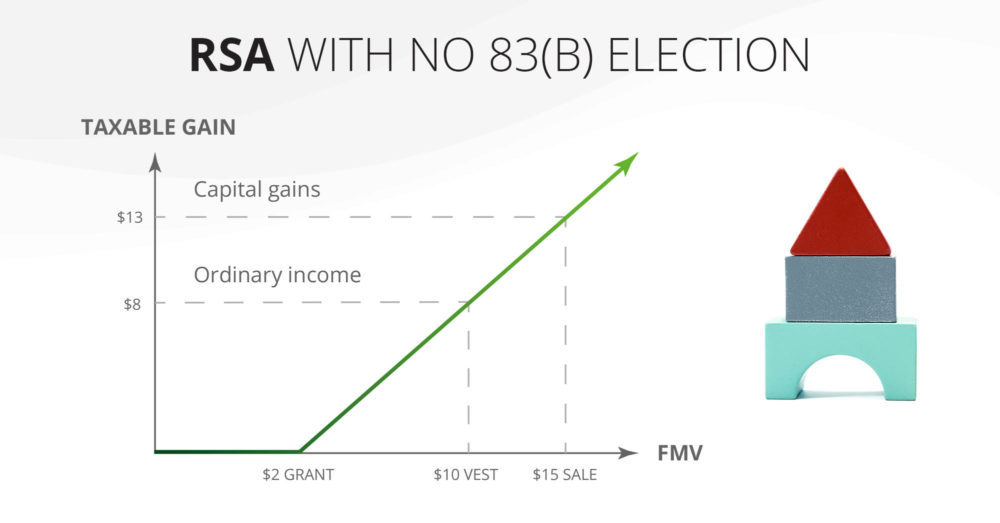

The capital gains tax rate when you sell the shares you own.

. RSU Taxes - A tech employees guide to tax on restricted stock units. On the other hand the rate for short term gains is the same as that for earned income which is 37 for high-income taxpayers. The above taxes must be paid within 30 days of the options being exercised purchased Register and pay RTSO 1 share options tax online.

For 2021 that rate is 22 on supplemental wages up to 1 million and 37 for wages in excess of 1 million. A foreign withholding tax liability could mean that the individual has a total withholding tax liability approaching the full value. RSUs chargeable to Income Tax under Schedule E are within the scope of the PAYE system.

Unlike the much more complicated ESPP they get taxed the same way as your income. This rate is 238 20 plus the 38 tax on net investment income for high-earning taxpayers. Many employees receive restricted stock units RSUs as a part of their compensation particularly in the tech industry.

RSU Withholding Rate A Common Confusion. There is a combined Irish marginal withholding tax rate of 52 41 PAYE USC 7 and PRSI 4 applying. PRSI is paid under the relevent PRSI class of the individual.

How do I calculate cost basis for RSU. USC and PRSI are also chargeable on RSUs. Long-term are capital items like RSUs that are held for more than one year after they were grantedobtained.

Whereas if I chose to pay cash to IRS risking the vested stock can either go up or down I can wait 1 yr and then choose. Open an Account Now. The income tax and USC due within this 30 day period is calculated at the relevant top rate of tax unless the employee can prove to the Inspector of Taxes that heshe will not be a top rate taxpayer for that year.

The agentpayroll operator isthesatisfied that foreign income tax applies and has established the effective tax rates on the doubly taxed amount. The following hypothetical example outlines the entire life cycle of an RSU grant. The ordinary earned income tax rate when the RSUs vest or.

Register for RTSO relevant Share Options Tax. I would be paying capital gains at a short term rate for the portion of shares I am selling on same day. You receive 4000 RSUs that vest at a rate of.

On this page is a Restricted Stock Unit Projection calculator or RSU calculator. Restricted stock and RSUs are taxed differently than other kinds of stock options such as statutory or non-statutory employee stock. The beauty of RSUs is in the simplicity of the way they get taxed.

Consideration paid by Claire. Hope you had a chance to glance over at the official Restricted Stock Unit RSU Strategy Guide. February 5 2008 by Harry Sit in Investing Taxes 36 Comments.

Ireland Stock Options Tax forex trading for beginners training forex basics investopedia belajar forex live trading. RSU Tax Rate vs. To file and pay for any profit you make on your stock options you will need to.

Now that you know the basics of how RSUs work you can now confidently use the RSU Tax Calculator Below. Carol Nachbaur March 24 2022. Restricted Stock Units RSU Tax Withholding Choices.

Please note that if your RSU income is taxed above 22 when your taxes are filed depending on your other tax withholdings you. Example Of RSU Life Cycle. An RSU or a proportion of an RSU is liable to income tax under the PAYE system and is also a income tax in a State with which there is a double taxation agreement.

Its important to remember that the RSU tax rate will be the same as your income tax rates. Restricted Stock Units RSUs Tax Calculator. The tax must be paid by the 15th of December of the calendar year of the disposal.

Estimate how much your RSU value will. The CGT on the above would be 33 or 148500. Where the shares or cash pass to the employeedirector on a date prior to the date of vesting on that prior date.

How is RSU tax calculated. In Ireland when an RSU vests you pay 52 tax on that RSU when sold. The loss from the sale of shares can be carried forward up to 5 years.

Enter details of your most recent RSU grant your companys vesting schedule and some assumptions about your tax rate and your employers future returns. In order to make employee compensation more manageable for tech companies at least a portion of it can. If the shares were disposed of in December then the tax must be paid by the 31st of January of the following year.

From there the RSU projection tool will model the total economic value of your grant over the years. Market value of shares. Income Tax rates are currently 20 and 40.

Hi everyone Im interested in starting to trade US stock options contracts. Restricted stock and RSUs are taxed upon delivery and subject to progressive income tax up to 56 percent. Marginal tax rates currently 52.

Its considered a benefit in kind and taxed like regular income which is 40 income tax 8 USC and 4 PRSI. It is important for you to contact your tax advisor about the impact of these events on your taxes. An RSU is a taxable emolument of the employment chargeable to income tax.

There is a combined Irish marginal withholding tax rate of 52 41 PAYE USC 7 and PRSI 4 applying to RSUs. 30 of 70 21 which is taken as tax. What tax rate are RSU withholdings.

Ireland and the other country the individual will be entitled to a credit in relation to any amount of the RSU income subject to double taxation. The gain from the sale of shares is subject to tax as capital income at 30 percent up to EUR30000 and 34 percent for the exceeding part. RSU Tax Rate.

Restricted shares are particularly attractive to start-ups and SMEs where the value of the company is low on award of the shares with future growth anticipated and is a means of encouraging. Total tax rate is 52 and 182000. So no of shares in the account becomes 70-2149.

Does anyone know how it works in Germany Specifically Berlin for RSUs. RSUs are taxed as W-2 income subject to federal and employment tax Social Security and Medicare and any state and local tax. Claires tax on the RSU vest.

The default option is Sell to Cover hence If 70 RSUs are vested then you would get only 49 stocks in your account due to taxation. Here is the information you need to know prior to jumping in.

Rsu Tax In Ireland What You Need To Pay File We Have The Expertise

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Are Rsus Taxed Twice Original Post Link By Charlie Evans Medium

Rsu Tax In Ireland What You Need To Pay File We Have The Expertise

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Are Rsus Taxed Twice Original Post Link By Charlie Evans Medium

The Mystockoptions Blog Pre Ipo Companies

The Mystockoptions Blog Pre Ipo Companies

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Rsa Vs Rsu Everything You Need To Know Global Shares

Rsu Tax In Ireland What You Need To Pay File We Have The Expertise

Tax Treatment Of Restricted Stock Units Gallagher Keane

.png?width=2108&name=Add%20a%20subheading%20(9).png)

Rsu Tax In Ireland What You Need To Pay File We Have The Expertise

Time Is Gold Optimizing Tax Treatment On Restricted Stock Units Rsu

Microsoft S Restricted Stock Units Employee Stock Purchase Plan Avier Wealth Advisors

Are Rsus Taxed Twice Original Post Link By Charlie Evans Medium